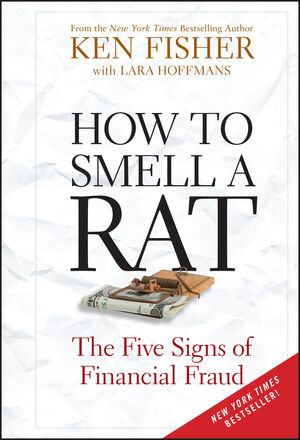

How to Smell a Rat: The Five Signs of Financial FraudISBN: 978-0-470-52653-8

Hardcover

224 pages

July 2009

Other Available Formats: Paperback

|

||||||

With five straightforward rules that would have saved any investor

from Bernie Madoff, investment firm CEO and Forbes columnist

Fisher (100 Minds That Made the Market) gives readers a

secure plan for fraud-proof investing, worthwhile for novices and

sophisticated financiers alike. Using the example of everyman

“Jim,” a precarious investor navigating shark-filled

waters, Fisher presents a clear, fast-paced, tightly organized

guide to principles like “Too good to be true usually

is,” and “Due diligence is your job, no one

else's.” Fully-referenced data, insider details,

laser-focused statistical digressions, and the finer points of

practical investing keep pages turning. Readers will value the

practical, easy-to-follow models of solid, transparent investment

strategies and examples from Fisher's experiences as CEO of his own

investment firm. Fisher also includes suggestions for further

reading and appendices that reproduce previously-published

comparisons of different asset allocations, information for small

business owners and short biographies of market-movers. Much more

than what to avoid, Fisher’s concise guide should be highly

illuminating and confidence-building for anyone with a bank

account. (Aug.) Starred review (Publishers

Weekly, September 2009)

Using well-known examples from recent headlines like Bernard Madoff and R. Allen Stanford along with a bevy of historical scam artists, Fisher details the red flags that should alert investors. They are: advisers who have access to your money; promises of returns that are too good to be true; mumbo-jumbo that takes the place of explaining investing strategy; fake benefits like exclusivity, and relying on someone else for due diligence. (Associated Press)